We generate a majority of our revenue from regulated or contractually defined businesses, which helps to protect our cash flow from significant fluctuations.

Creating Value for Shareholders

By investing in businesses such as Bristol Water, which features perpetual cash flow and an organic growth profile, and by positioning to participate in earlier-stage opportunities, we are working to drive long-term stability, increase value and maximize returns for shareholders.

Capstone is in business to deliver an attractive risk-adjusted total return to our shareholders by providing reliable income and capital appreciation.

Our building blocks for value creation include the inherent characteristics of our infrastructure businesses, which underpin the stability of our cash flow. They also include how we manage those businesses day to day and our ability to generate growth organically and through smart acquisitions and development projects while maintaining an appropriate capital structure.

Our power businesses represent approximately 370 megawatts of installed capacity under contract with creditworthy counterparties and are diversified by asset type, geographic location, PPA length and counterparty, and fuel source. These attributes result in predictable revenue. In addition, all our power facilities are characterized by high availability, which reflects the quality of operations, personnel and the ongoing maintenance programs. As a result, we expect these businesses to be stable cash flow generators over the terms of their contracts.

Bristol Water’s perpetual cash flow profile makes it the ideal complement to our power portfolio and positions this business to be a key contributor to Capstone’s long-term cash flow and overall value.

Bristol Water is regulated with a monopoly position in a growing region of the United Kingdom, which is a stable OECD country. The regulatory framework provides for the recovery of operating costs and an allowance for a fair return on capital. Historically, revenues have increased in line with the regulatory allowance and feature a real as well as an inflation component, thereby offering a natural inflation hedge.

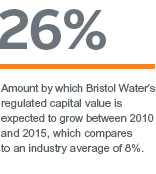

Over the current regulatory period that runs from 2010 to 2015, Bristol Water is executing the largest capital program in its history to improve and expand the company’s network of reservoirs, treatment facilities, water mains and pipes. As a high-growth utility with substantial investment in rate base required over the next 25 years, Bristol Water brings an organic growth profile to our portfolio.

We intend to complement the strengths of our portfolio by continuing to diversify our mix of businesses through acquisitions or development projects that deliver an attractive risk-adjusted return. At the same time, we continually monitor, analyze and seek to minimize the risks within our capital structure with a view to maintaining an optimal financing mix that suits the nature of our businesses, offers room for portfolio growth, and generates value for shareholders.

With our active asset management, disciplined approach to growth and capital management, and participation in the fast-growing infrastructure asset class, we are squarely focused on long-term success and increasing the value of our shareholders’ investment.

Bristol Water is implementing a systems modernization program that is saving money, making better use of resources, improving service to customers and lowering risk.

Finding New Value in Our Businesses

Sustaining and boosting the performance of our businesses depends on our ability to continually improve the way we do things.

It takes active management to turn good businesses into great ones that consistently deliver value to shareholders.

Every year, we undertake a rigorous strategic planning process and work side by side with the management teams at our businesses to identify new ways to increase value, whether it is finding a different revenue stream or achieving new efficiencies.

In 2012, Whitecourt sold renewable energy credits and recorded an additional $843,000 in revenue as a result. Whitecourt’s green attributes offer the potential for revenue growth in the future as companies increasingly seek to manage and reduce their carbon footprints. We continually assess opportunities for similar initiatives at our other renewable power facilities.

Comprehensive maintenance is another component of value creation because it helps to ensure that our power facilities consistently perform at a high level. In 2012, Cardinal, which runs on a six-year maintenance cycle, achieved a milestone for its Siemens gas turbine, which is a fleet leader globally: 150,000 hours of operations. This accomplishment reflects the reliable design of the turbine as well as the positive effect of regular preventative maintenance. Cardinal’s active approach to maintenance has also bettered the facility’s heat rate, which enhances efficiency.

For any business, continuous improvement and cost management are key drivers of performance and returns to shareholders.

At Erie Shores, in 2012 the team completed a gear box oil exchange program to introduce a new product that provides superior lubrication and wear protection, resulting in a significantly longer service life and reducing the total number of oil changes — and related costs — expected to be required over the life of the facility.

At Bristol Water, the team is currently executing an enterprise-wide program to modernize systems, achieve new operating efficiencies and deliver customer service improvements. The project has resulted in more robust capital expenditure, project and asset management processes, and includes a new information technology system that streamlines and enhances various operational and back-office functions. As a result, Bristol Water is saving money, making better use of resources, responding more effectively to customers and lowering risk as it strengthens its platform for continuing growth.

At Capstone, we believe that managing value for shareholders requires broad thinking about our company’s resources and how they can be used to create value — for today and tomorrow.

Employees across our businesses support community fundraising events, donate supplies and learning tools to local schools.

Delivering Value to Communities

Our employees have cultivated strong relationships with stakeholders, including suppliers, customers, landowners and communities.

The physical nature of infrastructure and the essential profile of the services our businesses provide mean that they have deep ties to the communities in which they operate.

For Capstone, it is a priority that our businesses act responsibly in executing their operations and growth plans and that they look for opportunities to share expertise that delivers value to the local community.

Bristol Water has a long history of working with communities to improve the environment and promote green initiatives that will pay dividends today and for years to come, whether it is fostering biodiversity action plans at its major treatment works and reservoirs, working with local landholders, supporting environmental leadership in the city of Bristol, or teaching the community about water’s vital role in the environment.

Up next for Bristol Water in 2013 is “Trout and About,” a project developed for students at four inner-city schools in Bristol. Together with the Avon Wildlife Trust, a local charity that works to protect wildlife, Bristol Water will provide a hands-on learning experience for students by educating them about the trout life cycle and the water environment.

In addition to generating environmentally-friendly electricity, Whitecourt provides Alberta farmers with the waste — fly ash — that biomass combustion produces. Every year, Whitecourt produces approximately 8,000 tonnes of fly ash, which is used by local farmers to help improve crop production. Fly ash boosts soil’s alkalinity, which creates a more favourable environment for soil microbiological activity and alters the soil’s chemistry, thereby improving the availability of several nutrients that plants need to grow.

Beyond environmental initiatives, employees across our businesses support community fundraising events, donate supplies and learning tools to local schools, and create employment opportunities to arm students with tangible skills. In 2012, our Sechelt hydro power facility participated in a training program to equip First Nations workers for careers in hydro power operations and facility maintenance. For 2013, Whitecourt has partnered with a non-profit organization that promotes career options for local youth to create a power engineering internship opportunity for a local high school student.

By demonstrating our commitment to corporate citizenship, Capstone’s businesses are realizing synergies with local communities and building win-win relationships that help to preserve and protect valuable resources, manage our environmental footprint and create the conditions for continuing success.

Bristol Water works with customers and communities to encourage responsible water use, thereby conserving a precious resource while keeping prices down.

Ensuring Value for Customers

The ability of our businesses to deliver on commitments and obligations to customers helps determine Capstone’s capacity to maximize long-term cash flow.

Creating value for shareholders and value for our business’ customers are two sides of the same coin.

Our businesses deliver essential services upon which people — and even life itself — depend. Clean, safe drinking water. Efficient, dependable heating in cold weather. And reliable electricity to illuminate homes and businesses and power the economy.

Simply, the ability of our businesses to deliver on their commitments or obligations to customers determines Capstone’s capacity to maximize long-term cash flow. Our businesses aim to achieve excellence in their operations while providing exemplary service and often collaborating with customers and other stakeholders towards common goals, whether it is working to conserve water or improve biodiversity or providing support to the electrical grid during times of emergency.

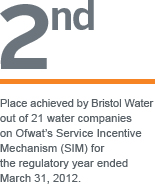

Bristol Water supplies water to more than 1.2 million people and businesses. During the year, Bristol Water achieved a strong top-quartile ranking on the industry regulator’s customer service measure, which gathers information through customer satisfaction surveys and quantitative data related to complaints. Strong customer service performance not only enhances a customer’s day-to-day experience but also helps to foster lasting customer support and can result in an increased revenue allowance for Bristol Water in the next regulatory review period.

Bristol Water also achieved the lowest level of water leakage in the company’s history, lowering water loss to 44 megalitres per day, which was approximately 15% below Bristol Water’s targeted level. This accomplishment required significant additional effort by Bristol Water’s team but reduced the risk of needing to impose water supply restrictions following sustained dry weather in the Bristol region during the spring. Efficient use of water helps protect the environment and conserves a precious resource while keeping prices down.

Closer to home, Cardinal, which commenced operations in 1994, is one of the largest gas cogeneration facilities in Ontario. It is also the newest power generation facility on the 115 kilovolt electrical grid in eastern Ontario.

Every year, Cardinal reliably generates enough electricity to power about 126,000 Ontario households. But the facility’s value proposition is multifaceted, extending well beyond the electrical outlet to include industrial and social benefits.

Cardinal also provides cost-effective steam, compressed air and electricity to Ingredion Canada Incorporated, its industrial host and one of Canada’s principal producers and suppliers of corn-based food ingredients and industrial products, for use in its manufacturing processes. Together, Cardinal and Ingredion employ 230 people, pay significant property taxes and actively support numerous community causes.

By striving to meet customers’ needs every day, our businesses are safeguarding Capstone’s financial performance, delivering ancillary benefits to the community, enhancing our company’s reputation and directly contributing to value for shareholders.

The need for infrastructure investment is large and growing. It is estimated that approximately $400 billion will be required by 2020 to plug Canada’s infrastructure deficit.

The Value of Investing in Infrastructure

Capstone’s focus on core infrastructure businesses positions us to offer shareholders reliable income and the potential for capital appreciation.

Capstone invests in core infrastructure businesses, which represent a distinct asset class with unique investment characteristics and benefits for investors.

What makes infrastructure an attractive investment opportunity?

Our day-to-day lives intersect with infrastructure in many ways, from the roads we travel to the water we drink and the electricity that powers our homes and businesses.

Simply, the services provided by infrastructure businesses are essential. As a result, infrastructure businesses enjoy consistent demand throughout the economic cycle. In addition, infrastructure businesses operate in environments where there are high barriers to entry, such as a regulatory or contractual framework. These businesses enjoy a long life, relatively low risk profile and strong competitive advantage that cannot be easily replicated. In addition, infrastructure businesses typically generate defined cash flow that is linked to measures of economic growth, providing investors with a hedge against inflation — which is particularly important in today’s economic climate.

Combined, these attributes result in predictable revenue and steady cash flow that is largely resistant to economic or market fluctuations.

In addition, infrastructure businesses have historically demonstrated low volatility relative to other asset classes, offering strong risk-adjusted return potential relative to equities and higher income potential than bonds. For investors, that means stable income, growth and a compelling total return.

While infrastructure delivers a number of benefits to an investment portfolio, it is not without risk. However, risks are typically more readily identifiable or can be mitigated. Revenue risk is mitigated through long-term contracts. Political risk is managed by investing in jurisdictions we are familiar with. And interest rate risk is managed through limited use of short-term debt.

The infrastructure asset class is poised for growth in the years ahead as the need for investment in critical infrastructure increases due to years of chronic underinvestment, population and economic growth, the challenges of climate change, and, more recently, increasingly strained public finances. Global infrastructure requirements for transport, energy, water and communications between 2013 and 2030 are estimated at more than US$57 trillion. The staggering amount of investment needed contributes to the potential for increasing private sector participation in infrastructure renewal and expansion.

Through Capstone, which intends to build a diversified infrastructure portfolio, investors have a unique opportunity to participate in — and benefit from — the infrastructure asset class.